Why Tax Credits Matter

About CPF and the Awards

The California Preservation Awards are a statewide hallmark, showcasing the best in historic preservation. The awards ceremony includes the presentation of the Preservation Design Awards and the President’s Awards, bringing together hundreds of people each year to share and celebrate excellence in preservation.

The California Preservation Foundation (CPF), a 501c3 nonprofit, was incorporated in 1978. We now support a national network of more than 36,000 members and supporters. Click here to learn how you can become a member.

Get CPF updates

Sign up below to receive advocacy alerts and updates from CPF.

Since February, the California Preservation Foundation and our partners from around the state have been working with elected representatives to pass SB 451, a bill to create a state historic tax credit. While projects are eligible for the Federal Historic Tax credit, California is one of only 15 states that does not yet provide a state tax credit to augment the federal. From 2002 to 2016, $468.1 million in federal tax credits catalyzed 169 projects in California, totaling $2.8 billion in qualifying rehabilitation expenditures. This activity has generated:

- 39,279 jobs.

- $2.8 billion in Gross State Product.

- $160 million in state and local taxes.

- $493.3 million in federal taxes

- $468.1 million in federal tax credits

SB 451 will provide further incentive for historic rehabilitation, increase the supply of affordable housing, support growth through infill development, and encourage property rehabilitation and maintenance in economically depressed areas. Below are a few examples of projects that could benefit from SB 451, but there are hundreds more stories just like these throughout California. The tax credit will make these kinds of projects more likely, and will encourage meaningful investments in communities across the state.

Social Media Kit - Help Spread the Word!

Want to help spread us spread the word and show #WhyTaxCreditsMatter? Use the text and images below to share tax credit success stories, and statistics that highlight the impact of this crucial legislation. When posting, please tag us on Facebook, Twitter, and Instagram.

Tax Credit Statistics

Optimized for Twitter

Since its inception, the Federal Historic Tax Credit has stimulated nearly $100 billion in rehabilitation investment. #WhyTaxCreditsMatter https://californiapreservation.org/why-tax-credits-matter/

The Federal Historic Tax Credit has spurred the creation of more than 300,000 new housing units, and the rehabilitation of more than 285,000 units. #WhyTaxCreditsMatter https://californiapreservation.org/why-tax-credits-matter/

The Federal Historic Tax credit has enabled the creation or rehabilitation of more than 166,000 low- and moderate-income housing units. #WhyTaxCreditsMatter https://californiapreservation.org/why-tax-credits-matter/

In California, between 2002-2016, 169 Federal Historic Tax Credit projects have resulted in nearly 40,000 jobs, and $2.8 billion in rehabilitation expenditures. #SB451 will make even more projects possible. https://californiapreservation.org/why-tax-credits-matter/

California is one of only 15 states without a State Historic Tax Credit in addition to the Federal. @CPF_SF is working with @AIACALIF and @SenToniAtkins on #SB451 which will help leverage private investment to reuse and preserve historic buildings. https://californiapreservation.org/why-tax-credits-matter/

Read about three projects that highlight important work that tax credits make possible at https://californiapreservation.org/why-tax-credits-matter/.

Optimized for Facebook

Since its inception, the Federal Historic Tax Credit has stimulated nearly $100 billion in rehabilitation investment. It has spurred the creation of more than 300,000 new housing units, and the rehabilitation of more than 285,000 units, including more than 166,000 low- and moderate-income housing units.

In California, between 2002-2016, 169 Federal Historic Tax Credit projects have resulted in nearly 40,000 jobs, and $2.8 billion in rehabilitation expenditures. California is one of only 15 states that do not have a State Historic Tax Credit in addition to the Federal. The California Preservation Foundation is working with AIA California and Toni G. Atkins on #SB451 which will help leverage private investment to reuse and preserve historic buildings.

Read about three projects that highlight important work that tax credits make possible at https://californiapreservation.org/why-tax-credits-matter/.

Tax Credit Success Stories

Click on each image below to download a higher resolution version to share on social media.

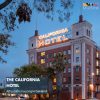

The California Hotel

#HistoricPreservation and Low-Income Tax Credits enabled rehabilitation of the 1930 California Hotel into apartments for low-income Oakland residents. This project is one of hundreds of recent projects that would have benefited from #SB451, the State Historic Tax Credit bill that will increase the supply of affordable housing, support growth through infill development, and encourage property rehabilitation and maintenance in economically depressed areas. Read more at https://californiapreservation.org/why-tax-credits-matter.

#HistoricPreservation and Low-Income Tax Credits enabled rehabilitation of the 1930 California Hotel into apartments for low-income Oakland residents. This project is one of hundreds of recent projects that would have benefited from #SB451, the State Historic Tax Credit bill that will increase the supply of affordable housing, support growth through infill development, and encourage property rehabilitation and maintenance in economically depressed areas. Read more at https://californiapreservation.org/why-tax-credits-matter.

Photo © Mark Luthringer

Twitter Length

Renovation of the California Hotel turned a historic hotel into apartments for low income #Oakland residents, one of hundreds of recent projects that would have benefited from #SB451. Read more at https://californiapreservation.org/why-tax-credits-matter.

Hollenbeck Terrace

Federal incentives enabled the adaptive reuse of the Santa Fe Coast Lines Hospital and Nurses’ Dormitory into low income housing for senior citizens. This project is one of hundreds of recent projects that would have benefited from #SB451, the State Historic Tax Credit bill that will increase the supply of affordable housing, support growth through infill development, and encourage property rehabilitation and maintenance in economically depressed areas. Read more at https://californiapreservation.org/why-tax-credits-matter.

Federal incentives enabled the adaptive reuse of the Santa Fe Coast Lines Hospital and Nurses’ Dormitory into low income housing for senior citizens. This project is one of hundreds of recent projects that would have benefited from #SB451, the State Historic Tax Credit bill that will increase the supply of affordable housing, support growth through infill development, and encourage property rehabilitation and maintenance in economically depressed areas. Read more at https://californiapreservation.org/why-tax-credits-matter.

Photo © AMCAL Multi-Housing, Inc.

Twitter Length

Adaptive Reuse at Hollenbeck Terrace turned a former hospital and dormitory into low income housing for seniors in #LosAngeles, one of hundreds of recent projects that would have benefited from #SB451. Read more at https://californiapreservation.org/why-tax-credits-matter.

San Francisco YMCA

The adaptive reuse of San Francisco’s Central YMCA restored the dignity of a beloved landmark and created an innovative integration of homes for the homeless, health and supportive services, a community gym, and an auditorium. This project is one of hundreds of recent projects that would have benefited from #SB451, the State Historic Tax Credit bill that will increase the supply of affordable housing, support growth through infill development, and encourage property rehabilitation and maintenance in economically depressed areas. Read more at https://californiapreservation.org/why-tax-credits-matter.

The adaptive reuse of San Francisco’s Central YMCA restored the dignity of a beloved landmark and created an innovative integration of homes for the homeless, health and supportive services, a community gym, and an auditorium. This project is one of hundreds of recent projects that would have benefited from #SB451, the State Historic Tax Credit bill that will increase the supply of affordable housing, support growth through infill development, and encourage property rehabilitation and maintenance in economically depressed areas. Read more at https://californiapreservation.org/why-tax-credits-matter.

Photo © Mark Luthringer

Twitter Length

Adaptive reuse of the Central YMCA in #SanFrancisco integrated new homes for the homeless with health and supportive services, a community gym, and more. This is one of hundreds of recent projects that would have benefited from #SB451. Read more at https://californiapreservation.org/why-tax-credits-matter/

Federal stats via https://www.nps.gov/tps/tax-incentives/taxdocs/tax-incentives-2018annual.pdf

The California Hotel

Historic Preservation and Low-Income Tax Credits enabled rehabilitation of the 1930 California Hotel, listed on the National Register, into apartments for low-income Oakland residents. Anchoring its local landscape, the finely detailed brick building presents two towers and a prominent electric sign toward its neighbors. The California Hotel was reconfigured from a 150-room hotel to 120 studios, 12 one-bedroom apartments and 5 two-bedroom apartments to provide housing for a range of low-income Oakland residents. Retaining its local prominence and fine detailing, the building now includes 4 program rooms, a community room and new laundries as well as a second elevator. Reviving a major community asset that had come on hard times, this project will provide safe and affordable supportive housing for decades to come.

Hollenbeck Terrace

Hollenbeck Terrace is an adaptive reuse project that transformed the Santa Fe Coast Lines Hospital and Nurses’ Dormitory in Boyle Heights into low income housing for senior citizens. The project utilized federal incentives for both historic preservation and affordable housing. The site was a natural fit for adaptive reuse into housing. With generously scaled corridors preserved, historic patient rooms were easily redesigned as apartments because of their essentially residential-scaled spaces, with windows providing ample natural light. Through the federal historic preservation tax credit process, the property was converted to 100 quality apartments for low-income senior citizens, along with common rooms and outdoor spaces for its new residents.

Hollenbeck Terrace is an adaptive reuse project that transformed the Santa Fe Coast Lines Hospital and Nurses’ Dormitory in Boyle Heights into low income housing for senior citizens. The project utilized federal incentives for both historic preservation and affordable housing. The site was a natural fit for adaptive reuse into housing. With generously scaled corridors preserved, historic patient rooms were easily redesigned as apartments because of their essentially residential-scaled spaces, with windows providing ample natural light. Through the federal historic preservation tax credit process, the property was converted to 100 quality apartments for low-income senior citizens, along with common rooms and outdoor spaces for its new residents.

San Francisco Central YMCA

The adaptive reuse of the 1909 Central YMCA in San Francisco restored the dignity of a beloved landmark. Designed by the prominent McDougall Brothers Architects, it is one of the few San Francisco examples of their practice remaining after the 1906 earthquake. The grand building now houses an innovative integration of homes for the homeless, health and supportive services, a community gym, and an auditorium. The building is not only beautiful – it also provides vital services and housing for chronically homeless people coming from the streets of San Francisco. The ground floor clinic, soon to be recognized as a LEED Gold Commercial Interior, is the Tenderloin’s largest, capable of serving 25,000 visitors annually. This rehabilitated structure promotes holistic well-being for San Francisco’s most vulnerable, while reducing public spending on hospitalizations.

The California Preservation Foundation is a sponsor of SB 451, and we need your support to secure passage of this crucial legislation. We expect this bill to cost CPF between $40,000 – $60,000 in direct and indirect costs. Your donation to the Advocacy Fund will be matched (up to $50,000) and will help us secure the passage of this important bill.

Photo Credits

Header image © Tom Myers

California Hotel Photo © Mark Luthringer

Hollenbeck Terrace Photo © AMCAL Multi-Housing, Inc.

YMCA Photo © Mark Luthringer

Trackbacks/Pingbacks